Funding Diversity 2020

Minority-led companies were the most hurt by the pandemic in 2020, seeing 26% less money raised compared to 2019. However, the average capital raised per company was the highest amongst all the groups researched, signaling that investors who did invest were more open to larger sum investments in each company.

What you can learn from this report:

- Funding comparison of diverse private companies between 2019 and 2020

- Funding concentration by state and city

- Verticals where funding was most concentrated

- A spotlight list of underrepresented companies

Introduction

Historically, women-founded or women-led organizations, as well as organizations led by minority groups receive less funding than companies founded or run by white men. Although society is continually shifting and awareness of the gaping differences and challenges for business-owners of underrepresented groups is rising, we take a closer look at how the COVID-19 pandemic has caused a decline for almost all minority groups despite the Black Lives Matter movement and subsequent pledges by many enterprises to support more diversity. Through this report and also the continuous improvements of its private market intelligence platform, PrivCo aims to spotlight underrepresented companies in the private market.

In this report, we compare funding and concentration of the funding by location and verticals, as well as spotlight companies to watch, grouping the companies tagged on PrivCo under minority-led, women-led, and women-founded. Women-led refers to companies with people publicly identifying as a female and part of the C-suite of the organization. Women-founded refers to companies with people who identify as female and are founders of the organization. Lastly, minority refers to people who are identified as non-white.

Key Findings

- Minority-led companies were the most hurt by the pandemic in 2020, dropping 26% in the money raised compared to 2019, from $2.3BN to $1.8BN. The number of companies that raised funds also halved.

- However, the average capital raised per company was the highest amongst all the groups researched, signaling that investors who did invest were more open to larger sum investments.

- While women-led and women-founded companies fared better in terms of capital raised, there was still a decline from $24.9BN in 2019 to $22.3BN in 2020. Female entrepreneurs managed to woo investors better than the companies that were women-led.

- In comparison, total funding raised grew from 2019 to 2020 from $130.2BN to $144.6BN. However, while the companies that raised funds dropped by 11.6%, the average funding size per company grew.

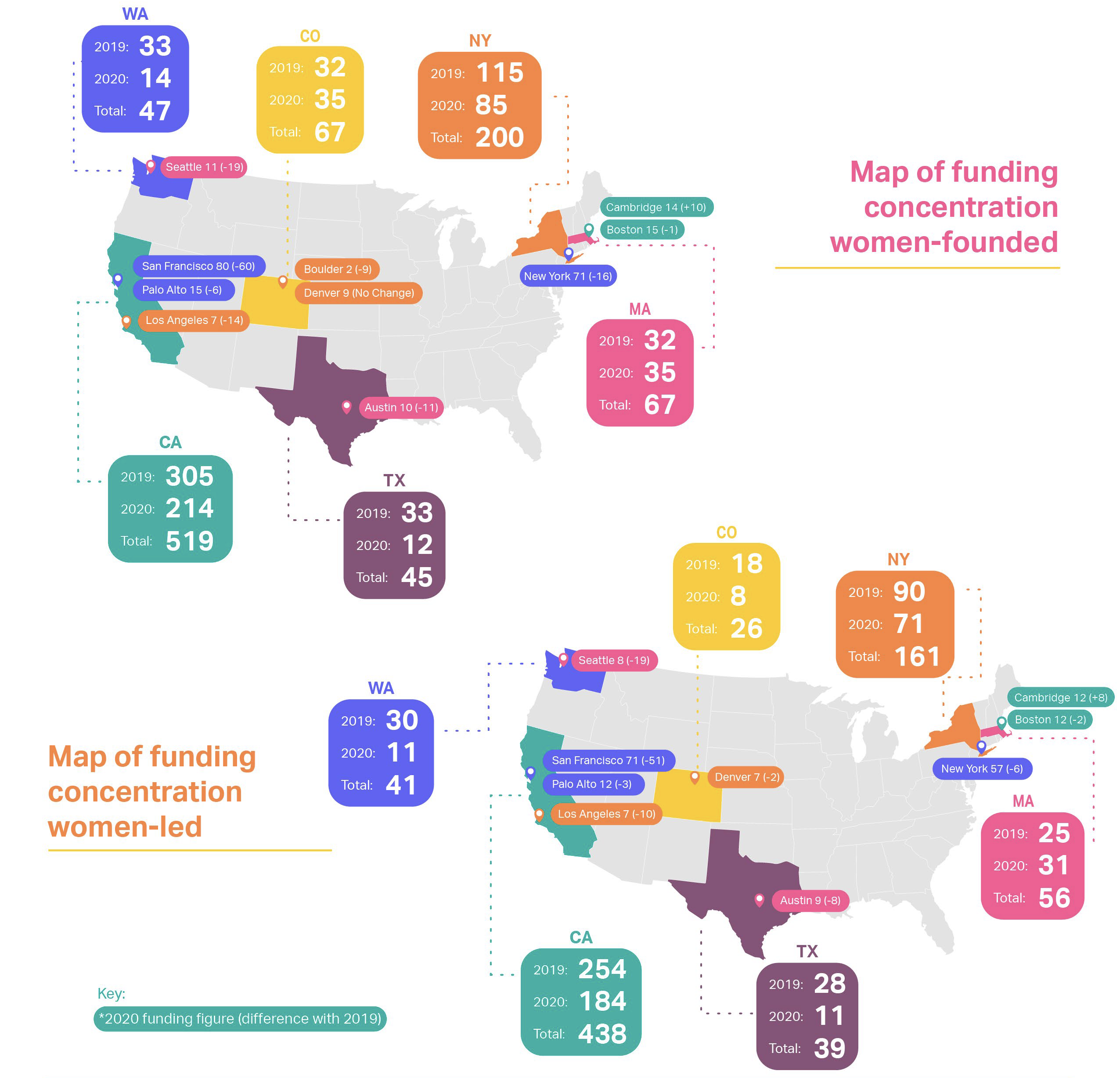

- Underrepresented groups that have raised funding tended to be headquartered in California or New York. While women-led or women-founded companies also were popular in Massachusetts, the closest third concentrated state of companies that raised funding that was minority-led was in Texas while Washington was also a thriving location for female leaders.

- Women leaders who raised funding operated in businesses in healthcare including biotech and R&D, as well as technology such as big data and SaaS.

- Meanwhile, minority-led companies lean towards E-commerce, finance, and education, as well as healthcare.

Diversity in 2020

2020 was a monumental year for recognizing diversity and inclusion. The deaths of Ahmaud Arbery, Breonna Taylor, George Floyd, and others lit a spark for many to bring once uncomfortable conversations of racial injustice to the dinner table, offices, and board meetings. This in turn has had a huge impact on how companies and governments react to advancing diversity, equity, and inclusion. Like the #MeToo movement in 2017, society as a whole are more eager to embrace and put diversity first when thinking about hiring and investing. While some companies may have rushed to implement some form of inclusion efforts into their company, in 2021, companies that don’t implement any inclusion efforts will be facing many challenges especially in acquiring talent and business.

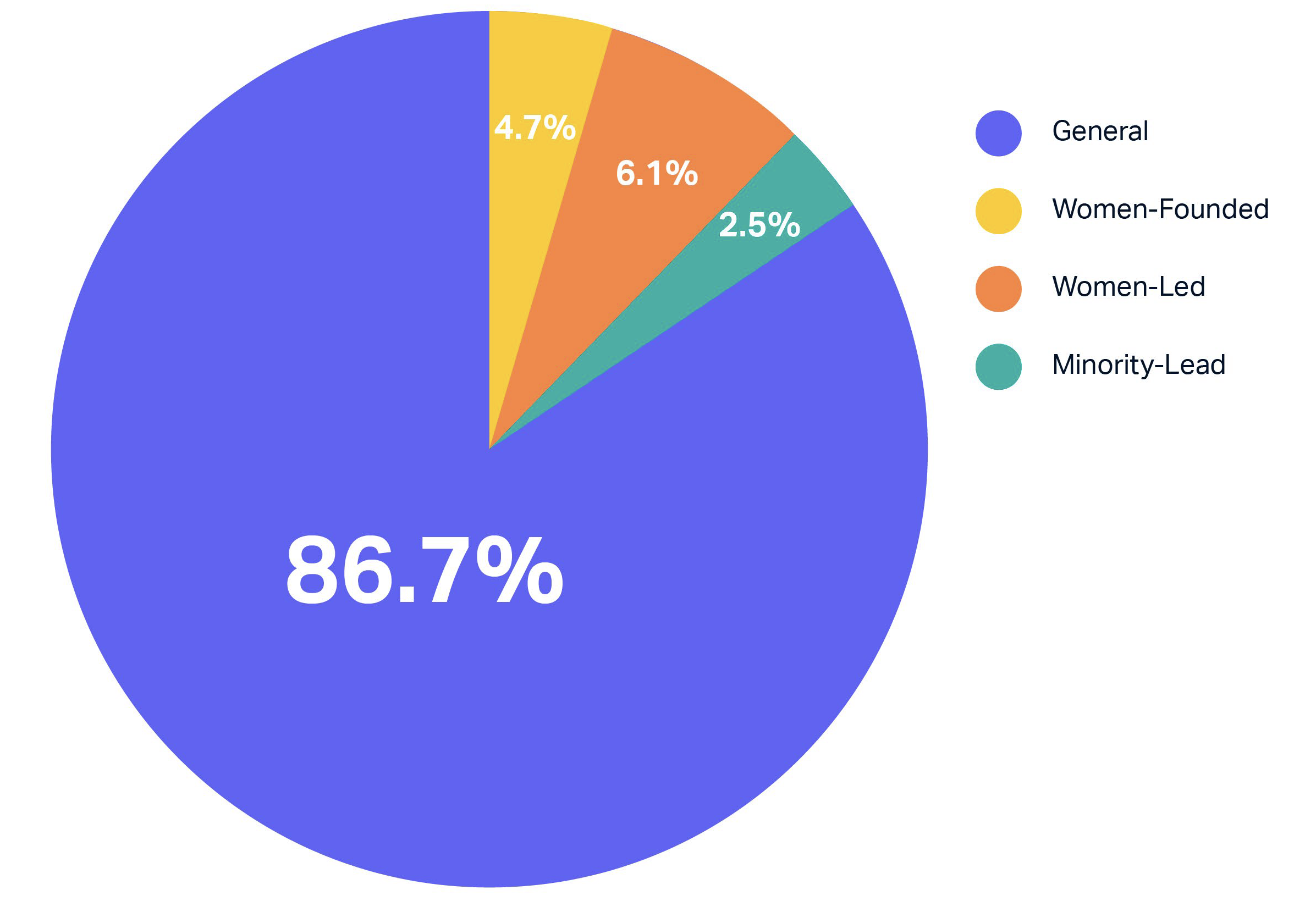

Breakdown of Recorded Company Types on PrivCo

Note: There is a slight % overlap of companies matching multiple tags, for example, women-found and women-led.

Minority Diversity

Minority-led companies were amongst the group most impacted by the pandemic. Although 2019 funding only represented 2.3% of the total funding raised in the same year by all companies, this dropped to 1.2% in 2020, or just $1.8BN. To put it into perspective, the total funding raised by minority-led companies is equal to Quibi alone, the failed content startup that shuttered in the same period and lost $1.75BN of capital raised.

Some Positive Notes

Not surprisingly, the number of companies who raised capital in 2020 also decreased by 80% but those who did, on average, raised $10MM more. This is $2.9MM more than the overall funding average per company, showing that while less companies raised funds, those that did gained the confidence of their investors.

Breaking Down the Data

- -26% — Decrease in minority-led capital raised in 2020 compared to the previous year

- 1.2% — Percentage of funding raised by minority-led companies vs. all companies 2020

- -80% — Decrease in companies that raised capital compared to the previous year

- 1.4% — Percentage minority-led companies that raised funding vs. all companies in 2020

- +2.9MM — Difference in raised capital per minority-led company in comparison to general funding between 2019 and 2020.

Concentration of Funding

Minority-led companies raised money were concentrated in the following verticals:

- Commerce

- Haircare

- Finance

- Education

- Marketplace

- Healthcare

- Enterprise software

Female Leaders

In the public world, all S&P 500 companies now have at least one woman on the board, and according to executive search firm Spencer Stuart of the 432 new independent directors added to S&P 500 boards, 59% were women and minority men. California took a step further to increase female leadership by enforcing a bill that requires public companies headquartered in California to name at least one female director by the end of 2019. Still, women leaders are rare. Of the 560+ IPOed companies in the past 12 months, only three were women-founded and only 8 had a female CEO.

In addition, according to a study by Mercer, women minorities continue to be underrepresented: 81% of women in executive roles are white compared to 6% who are Black, 3% who are Hispanic, and 8% who are Asian or Pacific Islander.

What About the Private World?

In the private world, women leadership fared better than the minority group, although still disproportionately less than white-led companies, with only 13.4% of raised funding falling to female leadership. Grouped altogether, companies with female leadership drew in 11.9% less funding than the previous year and the number of companies that raised funds dropped by 44.9%. However, companies that did raise funds, on average raised $7MM more than companies in 2019.

Founders vs. Leaders

When you break down and compare women-led companies versus women-founded companies, women-founded companies actually grew their funding raised in comparison to the previous year by 3.5% (although still 6.5% down from total funding growth of 10.0%). Racking in $8.9BN, female founders hustled their way to $8.8MM more funding on average per company, which is actually $1.5MM more than general funding. On the contrast, women-led companies averaged $5.7MM more capital per company in 2020, almost half of what women-founded companies managed to raise on average.

Breaking Down the Data

- -22.1% — Decrease in women-led companies’ capital raised in 2020 compared to the previous year

- 3.5% — Increase in women-founded companies’ capital raised in 2020 compared to the previous year

- 50% — Women-led companies only raised half of what women-founded companies raised per company average

Women-led companies raised money were concentrated in the following verticals:

- Healthcare

- Research & Development

- Enterprise software/SaaS

- Biotechnology

- Manufacturing

- Artificial intelligence

- Big Data

- Analytics

Women-founded companies raised money were concentrated in the following verticals:

- Technology

- Healthcare

- Software

- Biotechnology

- E-commerce

- Apparel

Concentration of Funding

Company Spotlight

| Company | Location | Vertical | Classification |

|---|---|---|---|

| Beauty Bakerie | San Diego, CA | E-commerce | Black-founded, Women-founded, Women-led, Minority-led |

| One Trust | Atlanta, GA | Compliance Software & Internet Services | Minority-led |

| Noom | New York, NY | Fitness Software & Internet Services | Minority-led |

| Squire | New York, NY | Personal Care Software & Internet Services | Black-founded, Minority-led |

| Cadre | New York, NY | Real Estate Software & Internet Services | Black-founded, Minority-led |

| Compass | New York, NY | Real Estate Software & Internet Services | Black-founded, Minority-led, Women-led |

| Verge Genomics | San Francisco, CA | Biotechnology | Asian-founded, Women-founded, Minority-led |

| BetterUp | San Francisco, CA | Education Software & Internet Services | Minority-led |

| Amplitude | San Francisco, CA | Analytics Software & Internet Services | Minority-led |

| Fiscal Note | Washington, DC | Analytics Software & Internet Services | Asian-founded, Minority-led |

| Summersalt | Sanint Louis, MO | Apparel, Footwear & Accessories | Women-founded, Women-led |

| Laurel & Wolf | West Hollywood, CA | Interior Design Software & Internet Services | Women-founded, Women-led |

| Run the World | Mountain View, CA | Conference Software & Internet Services | Asian-founded, Women-founded, Women-led |

| Brightway Insurance | Jacksonville, FL | Insurance Services | LGBTQ, Minority-led |

| Leprino Foods | Denver, CO | Food & Beverage Producers | LGBTQ-led |

| Land O Lakes | Saint Paul, MN | Agricultural Products | LGBTQ-led, Women-led |

| Arcus | New York, NY | Fintech | Minority-led, Latinx |

| Brex | San Francisco, CA | Consumer Finance | Minority-led, Latinx |

Endnotes and Methodology

The data contained in this report comes directly from PrivCo and is based on data and calculations from the PrivCo database at the time of writing in February 2021. The data is focused on the U.S. market of privately-owned companies based on their performance including funding in the 2019 and 2020 calendar year.

Women-led refers to companies with people publicly identifying as a female and part of the C-suite of the organization. Women-founded refers to companies with people who identify as female and are founders of the organization. Minority refers to people who are identified as non-white.

PrivCo’s dataset is constantly expanding and as data is added to the platform over time, some of the numbers in this report may shift at the time of viewing in comparison to the platform. A company may not have founders listed, or the data may not be updated on PrivCo’s company profile yet.

If you notice missing data or want to request updates, please reach out to research@privco.com.